The formal USS consultation on the revised pension closes in two days time this Friday. Please take advantage of your opportunity to respond. They don’t make it easy (they wouldn’t, would they); you need your USS member number and your National Insurance Number. You will be able to find your member number on any official USS correspondence, including the invitation to respond, or you can call University extension 22445 and ask. You then go to this web page (https://www.ussconsultation.co.uk/members/sign_in) and sign in. Realistically, comments at this formal stage can only affect details of the proposed scheme; we have already reached (reluctant) agreement about the core of the changes.

I’d caution you about using the various benefit calculators; I have seen three (UCU, UCEA, USS) and they all make different fragile assumptions.

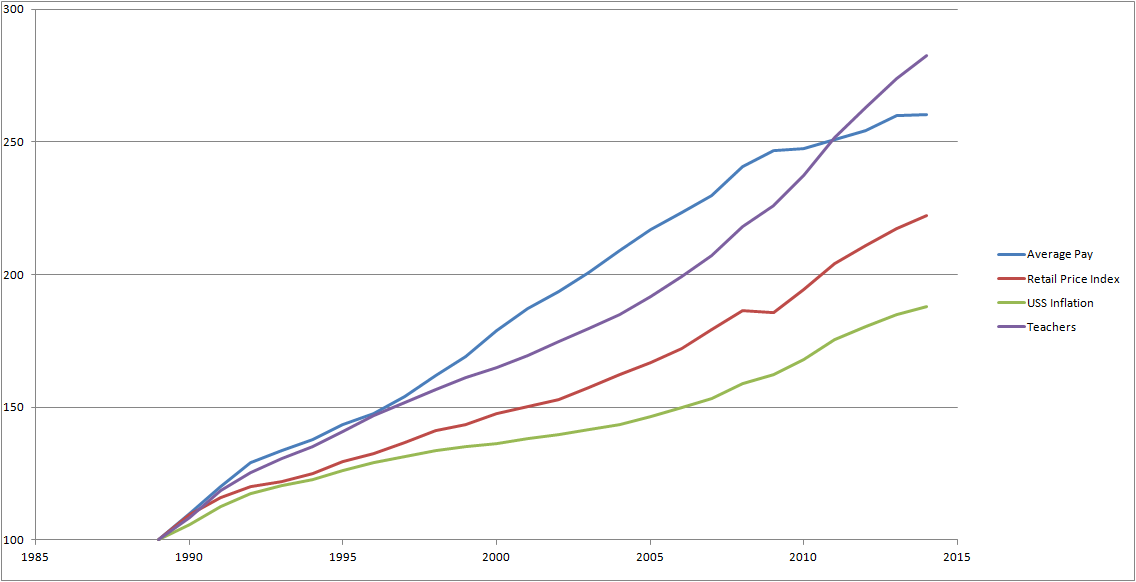

The hard core of what has been imposed on us is the inadequate inflation protection. They call it USS inflation and it is slightly worse than CPI (with restrictions above 5%). The graph below should explain the problem. It’s based on ONS figures and only goes back to 1989, as that’s the first date of official CPI numbers.

Click on it if you need a bigger version.

Click on it if you need a bigger version.

You can see the problem at a glance. If we had no career advancement and no annual increments, we would expect our pay to rise at the same rate as average annual pay in the UK. Thus even without annual increments or promotion, we would expect the 1/80th of a £20,000 salary that we earned in 1989 to be worth £650 if it were based on final salary, as average pay has multiplied by a factor of 2.6 over the period. In contrast, USS inflation (capped CPI) has only multiplied by a factor of 1.88 over the period, so even with the improved 1/75 accrual rate, you only get a pension of £501 twenty-five years later. You lose even without taking account of career progression. The teachers, in TPS, have negotiated inflation protection of CPI+1.6%; this roughly keeps up with average pay.

Why did the teachers get a better deal? Perhaps because of greater Union strength and militancy. The sad reality is that our scheme is supposed to be fully funded; there is meant to be enough money in it to pay our pensions. That allows the government pensions regulator, the USS staff, and the USS trustees (typically from the banking and government sectors) to impose very conservative actuarial assumption to force down benefits. They have even adopted de-risking which is banking-talk for deliberately selecting worse-performing investments which make the deficit bigger. And they have imposed a defined contribution section because, in their language, it is risk-free. It’s risk-free because we take all the risk. The teacher’s scheme, on the other hand, has no money at all, so they don’t have any actuarial rules to follow.

So what can you usefully say in your response? Feel free to rehearse the sad story above, but I doubt you’ll get far. I would concentrate on the defined contribution component, and address a couple of key issues:

- The new USS is a very complex hybrid scheme. There is legacy final salary, legacy added years AVC, Prudential AVC, CRB, DB (with optional extra matched and unmatched contributions) and possibly a further cash purchase AVC option. This all gives the scheme staff an opportunity to spend money and impose fees. Insist that the fees on the DB parts of the scheme be kept low, well below the current 0.84% average as we are a very big scheme which should be very efficient.

- All the risk in the DB part is carried by us, the members. So we (not the trustees) should be able to select the range of investment vehicles on offer. A member-led panel should be created for the purpose. We are likely to want various sorts of ethical and low-fees funds.

Here are some other suggested responses:

Denis Nicole